Talking Points | From Beijing to the Bosphorus: New Opportunities in China - Türkiye Trade

By the Basilinna Team in partnership with Corpera

November 15, 2024

Mehmet Simsek, Turkish Minister of Treasury and Finance, and Chinese Vice Premier Zhang Guoqing.

Your Talking Points

Growing Türkiye-China Partnership: Recently concluded high-level meetings in Beijing along with Türkiye’s application to join the BRICS platform underscore strengthened economic ties and strategic alignment with China’s Belt and Road Initiative.

Türkiye’s Gateway Advantage: Türkiye’s role in the Middle Corridor offers Chinese companies a stable route to Europe, including potential for tariff-free exports given its customs union with the EU, significant due to current tensions around Chinese EVs.

Global Diversification Strategy: For Chinese companies in sectors like infrastructure, energy, and technology, there will be growing opportunities in Türkiye. In face of a likely hardening economic relationship with the U.S. following Trump’s reelection, markets like Türkiye, while small, may become an important part of China’s international economic strategy.

Digging Deeper

Türkiye-China economic relations continue to strengthen as Turkish Treasury and Finance Minister Mehmet Simsek wrapped up a visit to Beijing on November 8. There he had a series of high-level meetings with China’s government and financial leadership, including Vice President Han Zheng, Vice Premier Zhang Guoqing, and leaders from ICBC, Bank of China, and Asian Infrastructure Investment Bank (AIIB). China is already Türkiye’s largest trade partner in Asia and third largest globally, with bilateral trade exceeding $48 billion in 2023. The high-level engagement, coupled with Türkiye’s recent request to join BRICS, amplifies the strategic importance of this bilateral relationship, and signals an important moment for expanding bilateral trade and investment.

The anchor of Simsek’s visit was the Second Meeting of the Türkiye-China Intergovernmental Cooperation Committee, founded in 2015 to promote cooperation, and which is chaired by Simsek and Chinese Vice Premier Zhang Guoqing, who oversees trade with Central Asia and bordering countries. Discussions focused on aligning Türkiye’s Middle Corridor Initiative with China’s Belt and Road Initiative (BRI), with commitments to strengthen cooperation in infrastructure financing, energy, tourism, civil aviation, and agriculture. Both sides agreed to further increase mutual investments, opening new doors for investors seeking opportunities amid shifting geopolitical landscapes.

Türkiye Has Become a Hub for Chinese Trade and Investment

Türkiye has become a unique investment opportunity for Chinese companies, particularly those looking to access the wider European market. Chinese FDI in the market surged after Türkiye signed onto China’s BRI in 2015. Chinese investments rose sharply from $82 million before the BRI agreement to $624 million in 2016, peaking at $1.7 billion in 2022, according to the Turkish Central Bank.

Leading Chinese firms such as Alibaba, BYD, and Huawei have already established a strong presence in Türkiye. At the China-Europe Leadership Forum in Beijing in early 2024, Türkiye was featured as a strategic gateway for Chinese firms who want to expand into Europe. Following the forum, BYD, a major Chinese EV manufacturer, announced plans to build a $1 billion car factory in Türkiye. This decision comes amid the EU’s new tariffs on Chinese-made EVs which makes exports to the European Union more expensive, but because of Türkiye’s customs union with the EU, vehicles produced in Türkiye can enter the EU tariff-free.

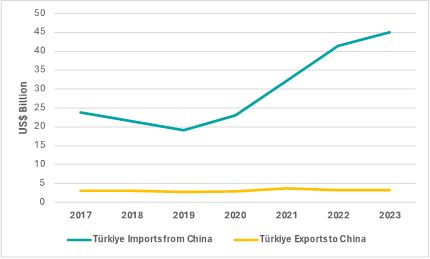

Türkiye, like most other major markets, struggles with a severe trade imbalance with China. In 2023 alone, Türkiye imported nearly $45 billion in goods from China, while exports to China were only $3.3 billion (see Figure 1). To alleviate potential concerns with this imbalance, both Zhang Guoqing and Wang Yi have pledged in their discussions with Turkish leaders to increase “high quality” imports from Türkiye and encourage more Chinese companies to invest directly in the country. Given this significant imbalance, it will be important to watch whether the protectionist fever sweeping the United States and European Union blows into Türkiye or if its collaborative approach will pay off.

Figure 1. The Trade Imbalance Between China and Türkiye is Widening

Source: World Bank

The Middle Corridor Meets the Middle Kingdom

Beyond the cooperative approach, Türkiye’s strategic location provides Chinese firms an edge and an important competitive advantage as it becomes more challenging to access the EU. As a pivotal link in the 7,000-kilometer Middle Corridor—a trade route connecting China to Europe through Central Asia—Türkiye is a faster, more efficient alternative to the Northern Corridor via Russia and the traditional Ocean Route, with transit times of just 10 to 15 days (see Figure 2). Moreover, it provides a way to skirt the Ukraine conflict in the North and the Southern routes’ choke points.

Figure 2. Türkiye’s Strategic Location Offers Unmatched Opportunities

Source: Baku Research Institute

What to Watch

For Chinese companies, there are growing opportunities in Türkiye, especially with the political will and support from senior leadership in both countries to grow the trading relationship. The challenge now lies in bringing this potential to fruition. While the Turkish market is not itself large, it could be an important strategic entry point for companies entering the European Union, Central Asia and the Middle East, especially as China seeks to offset what could be a very tough environment with the U.S. after the election of President Trump. It will be interesting to watch if Türkiye can balance its own position between the interests of the European Union and China.

Developed in partnership with Corpora. Published by Basilinna Institute. All rights reserved.